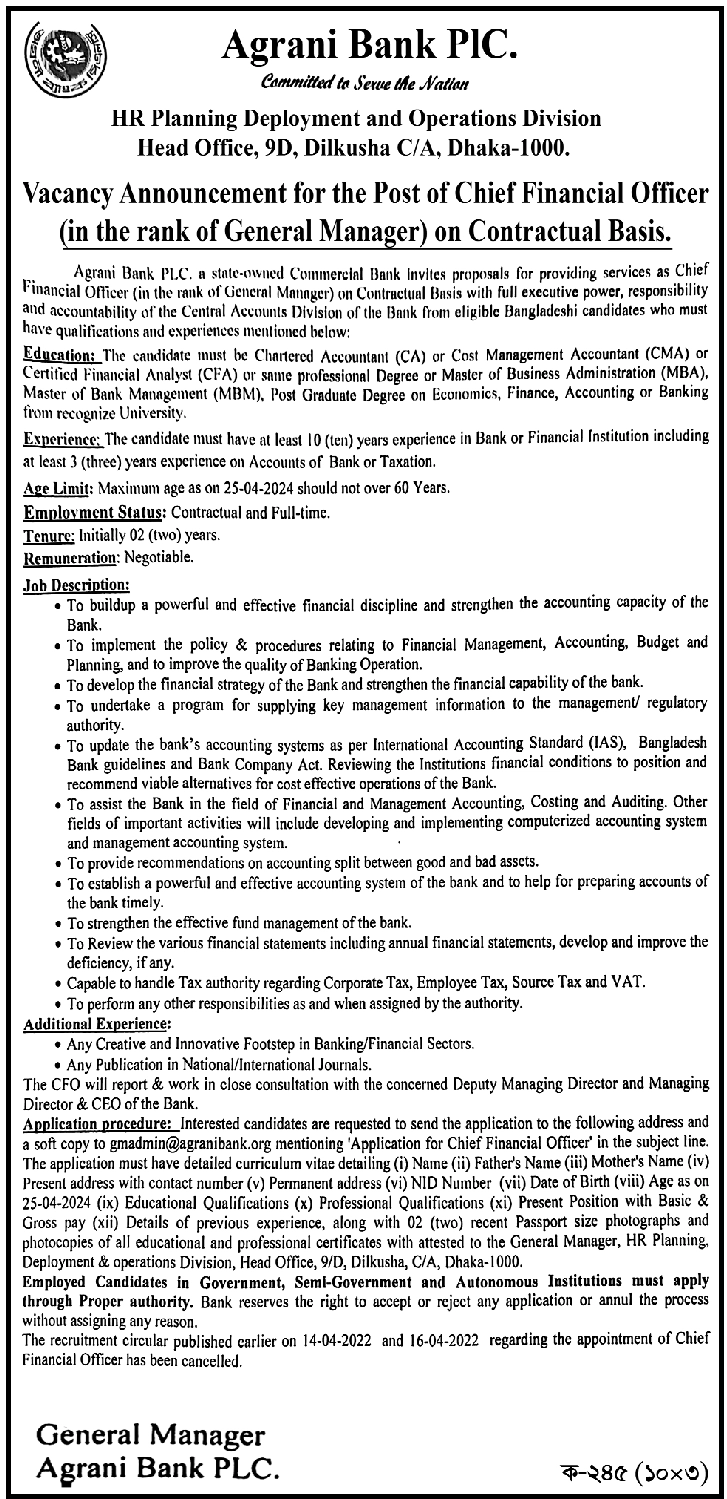

Agrani Bank PLC.

Job Category: Banking/Non-Banking

Job Source: দৈনিক ইত্তেফাক

Posted On: 25 Mar 2024

Application Deadline:25 Apr 2024

Welcome to our website bangladeshtodays.org. This is the best website online. Here you will get daily updates on all types of job news such as: E.g Job Vacancies in Public Sector, Private Sector, Corporate, Banking, NGO Jobs etc. You can select any type of job from the category option in the top menu of the website. You can apply for jobs directly on our website. There is a search option at the top of this website where you can search for jobs according to your requirements. If you have benefited even in the slightest from our website, then you can tell your friends, family and everyone else about this website. I hope you also benefit from this website. You can share this website post on Facebook, Instagram, Twitter or any other online platform if you want. Many people can benefit from your sharing. And if there is anything you want to know or understand, you can contact us by email on the contact page of this website. We will try our best to help you, thank you very much.

**Introducing Agrani Bank PLC:** Agrani Bank PLC is one of the leading commercial banks in Bangladesh and plays a pivotal role in the banking sector and economic development of Bangladesh. Founded in 1972, Agrani Bank has grown into a leading financial institution offering a wide range of banking products and services to individuals, businesses and government agencies across Bangladesh. With a focus on customer centricity, innovation and financial inclusion, Agrani Bank has become synonymous with trust, reliability and excellence in the banking industry. **History and Establishment:** Agrani Bank’s origins date back to the nationalization of banks in Bangladesh after Bangladesh’s independence in 1971. The bank was established through the merger of his two former banks, Agrani Bank and Pakistan Bank of Commerce. Since its establishment, Agrani Bank has been dedicated to serving the financial needs of various customer groups and contributing to economic growth, poverty alleviation and sustainable development of Bangladesh. **Mission and Goals:** Agrani Bank PLC’s mission is to be a customer-centric, technology-driven financial institution committed to providing innovative banking solutions, driving economic growth and increasing shareholder value. The bank’s goals include: 1. **Customer Satisfaction:** We provide world-class banking services, personalized customer experiences, and innovative financial solutions tailored to the needs of our retail and business customers. 2. **Financial Inclusion:** Promote financial inclusion and expand access to banking services to underserved and marginalized populations, including rural areas, women entrepreneurs, and small businesses. 3. **Risk Management:** Implementing robust risk management practices, internal controls, and compliance standards to protect the Bank’s assets, ensure financial stability, and reduce operational, credit, and market risks. To do. 4. **Profitability:** Achieving sustainable growth, profitability, and operational efficiency through prudent financing practices, diversifying revenue sources, and cost-effective operations, while maximizing shareholder value. 5. **Corporate Governance:** Adhere to the highest standards of corporate governance, transparency and ethical behavior in all business activities and promote trust, integrity and accountability among stakeholders. 6. **Innovation and Technology:** Leverage technology advances, digital banking solutions, and automation tools to improve operational efficiency, customer convenience, and service delivery channels. **Products and Services:** Agrani Bank PLC offers a comprehensive range of banking products and services to meet the diverse financial needs of its customers. The bank’s main products and services include: 1. **Deposit Accounts:** Agrani Bank offers a variety of deposit accounts such as savings account, current account, term deposit, term deposit, etc. with competitive interest rates and flexible terms to suit customer preferences. We offer 2. **Loans and Advances:** The bank offers personal loans, business loans, agricultural loans, small business loans, consumer loans, etc. to help individual and corporate borrowers achieve their financial goals and aspirations. We offer a wide range of credit products. 3. **Trade Finance:** Agrani Bank provides trade finance services such as letters of credit (LC), guarantees, import and export financing, and document collection to facilitate international trade transactions and reduce trade-related risks for businesses. doing. 4. **Money Transfer Services:** The Bank offers both inbound and outbound money transfer services to facilitate the transfer of funds domestically and internationally, allowing customers to send and receive money quickly, securely and cost-effectively. I will make it possible for you to receive it. 5. **Electronic Banking:** Agrani Bank offers e-banking services such as ATM, Debit Card, Internet Banking, Mobile Banking, and SMS Banking to enable customers to easily access their accounts and conduct transactions anytime and anywhere. and help you manage your finances. . 6. **Investment and Wealth Management:** The Bank provides investment advisory services, wealth management solutions, and mutual funds to help customers build wealth, diversify their investment portfolios, and achieve financial security. We offer capital market products such as , bonds and stocks. 7. **Insurance Products:** Agrani Bank, in partnership with reputed insurance companies, offers a wide range of life insurance, health insurance, non-life insurance, etc. to provide financial protection and security to its customers and their families. We offer insurance products. **Branch network and sales channels:** Agrani Bank PLC has an extensive branch network and distribution channels across Bangladesh, ensuring access and convenience for customers in urban, semi-urban and rural areas. The bank’s branch network is complemented by a variety of digital and alternative distribution channels, including: 1. **Branch:** Agrani Bank operates a network of strategically located branches across the country, providing personalized banking services, advisory support and customer care to individuals, corporates and institutions. 2. **ATM:** The Bank provides ATM services at select branches and off-premises locations where customers can withdraw cash, check balances, transfer money and perform other banking transactions 24 hours a day. can do. 3. **Internet Banking:** Agrani Bank offers Internet banking that allows customers to access their accounts, view transaction history, send money, pay bills, and perform other banking activities securely over the Internet. Provides functionality. 4. **Mobile Banking:** The Bank offers mobile banking services through a dedicated mobile app and USSD code, allowing customers to conduct banking transactions, receive notifications and access banking services through their mobile phones. I can. 5. **Agent Banking:** Agrani Bank has launched agent banking services in collaboration with authorized agents, dealers and local entrepreneurs to provide well-served services in remote areas through agent branches and service points. We are expanding banking services to those who cannot afford to pay or have no bank account. 6. **Online Payment Services:** The Bank facilitates online payment services, bill payments, money transfers and e-commerce through a secure payment gateway.