Agrani Bank PLC.

অগ্রণী ব্যাংক পিএলসি

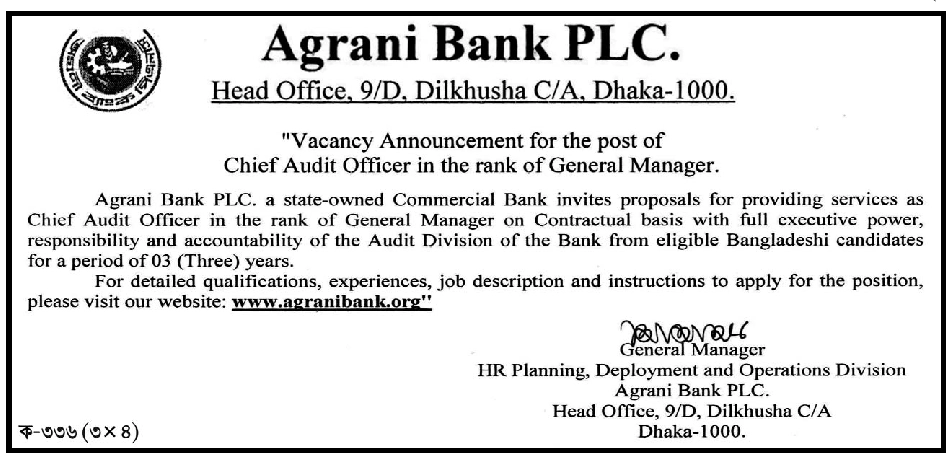

| Job Category: Govt. Job Job Source: দৈনিক ইত্তেফাক Posted On: 2 May 2024 Application Deadline:31 May 2024 |

Web: www.agranibank.org

Apply

Welcome to our website https://bangladeshtodays.org/. This is the best website online. Here you will get daily updates on all types of job news such as: E.g Job Vacancies in Public Sector, Private Sector, Corporate, Banking, NGO Jobs etc. You can select any type of job from the category option in the top menu of the website. You can apply for jobs directly on our website.There is a search option at the top of this website where you can search for jobs according to your requirements. If you have benefited even in the slightest from our website, then you can tell your friends, family and everyone else about this website. I hope you also benefit from this website. You can share this website post on Facebook, Instagram, Twitter or any other online platform if you want. Many people can benefit from your sharing.And if there is anything you want to know or understand, you can contact us by email on the contact page of this website. We will try our best to help you, thank you very much.

### Agrani Bank PLC: A Pillar of Economic Development

#### Introduction

Agrani Bank PLC, one of Bangladesh’s leading state-owned commercial banks, plays a pivotal role in the country’s financial sector. Established in 1972, the bank has grown to become a cornerstone of Bangladesh’s economic development, offering a wide array of banking services to individuals, businesses, and government entities. Its extensive network, robust financial products, and commitment to innovation and customer service have positioned Agrani Bank as a trusted financial partner in the region.

#### Historical Background

Agrani Bank was formed in the aftermath of Bangladesh’s independence, following the nationalization of banks by the government to rebuild the war-torn economy. The bank was established by merging two abandoned Pakistani banks: Habib Bank Ltd. and Commerce Bank Ltd. This merger aimed to stabilize the financial sector and provide essential banking services to the population. Over the years, Agrani Bank has undergone significant transformations, including restructuring efforts to improve efficiency, service quality, and financial performance.

#### Organizational Structure

Agrani Bank PLC operates under a well-defined organizational structure designed to facilitate efficient management and service delivery. The key components of its structure include:

1. **Board of Directors**: The board, comprising experienced professionals and government representatives, oversees the strategic direction and governance of the bank. They ensure that the bank’s operations align with its mission and regulatory requirements.

2. **Executive Management**: The executive team, led by the Managing Director and CEO, is responsible for implementing the board’s policies and managing day-to-day operations. This team includes various functional heads overseeing departments such as retail banking, corporate banking, risk management, and information technology.

3. **Branch Network**: Agrani Bank boasts an extensive network of over 950 branches across Bangladesh. This network enables the bank to serve a broad customer base, including rural and urban areas, and facilitates financial inclusion.

4. **Subsidiaries and Affiliates**: To diversify its services and enhance its market presence, Agrani Bank has established several subsidiaries and affiliated companies. These entities operate in areas such as insurance, securities, and asset management.

#### Products and Services

Agrani Bank PLC offers a comprehensive range of banking products and services tailored to meet the diverse needs of its customers. These include:

1. **Retail Banking**:

– **Savings Accounts**: Various savings account options cater to different customer segments, offering competitive interest rates and easy access to funds.

– **Current Accounts**: Designed for businesses and individuals requiring frequent transactions, these accounts provide flexibility and convenience.

– **Fixed Deposits**: Customers can choose from a variety of fixed deposit schemes with attractive interest rates and flexible tenures.

– **Loans and Advances**: Personal loans, home loans, car loans, and education loans are among the many credit products available to individual customers.

2. **Corporate Banking**:

– **Working Capital Finance**: Solutions such as overdrafts, cash credits, and short-term loans help businesses manage their day-to-day operations.

– **Term Loans**: Long-term financing options support business expansion, capital expenditure, and project development.

– **Trade Finance**: Services like letters of credit, guarantees, and export-import financing facilitate international trade for businesses.

3. **SME Banking**:

– **Microfinance**: Agrani Bank provides microcredit to small entrepreneurs and cottage industries, promoting economic development at the grassroots level.

– **SME Loans**: Tailored loan products cater to the unique needs of small and medium enterprises, helping them grow and thrive.

4. **Agricultural Banking**:

– **Agricultural Loans**: Specialized loan schemes support farmers and agribusinesses, enhancing productivity and sustainability in the agricultural sector.

5. **Digital Banking**:

– **Online Banking**: Customers can access their accounts, transfer funds, and pay bills through a secure online platform.

– **Mobile Banking**: Agrani Bank’s mobile banking app allows customers to perform banking transactions on the go, ensuring convenience and accessibility.

– **ATM Services**: A wide network of ATMs across the country provides customers with 24/7 access to their accounts.

#### Financial Performance

Agrani Bank PLC’s financial performance is a testament to its stability and growth over the years. Key performance indicators include:

1. **Asset Base**: The bank has a robust asset base, which has grown consistently through prudent financial management and strategic investments.

2. **Deposit Mobilization**: Agrani Bank’s extensive branch network and customer-centric approach have resulted in substantial deposit growth, reflecting customer trust and confidence.

3. **Loan Portfolio**: The bank’s diversified loan portfolio spans various sectors, contributing to balanced growth and risk management.

4. **Profitability**: Despite challenges in the banking sector, Agrani Bank has maintained steady profitability, supported by efficient operations and effective cost management.

#### Contribution to Economic Development

Agrani Bank PLC plays a significant role in Bangladesh’s economic development through various initiatives and programs:

1. **Financial Inclusion**: The bank’s efforts to extend banking services to rural and underserved areas have promoted financial inclusion, empowering individuals and small businesses with access to financial resources.

2. **Agricultural Development**: By providing tailored financial solutions to the agricultural sector, Agrani Bank supports increased productivity, food security, and rural development.

3. **SME Support**: The bank’s focus on small and medium enterprises fosters entrepreneurship, job creation, and economic diversification.

4. **Infrastructure Financing**: Agrani Bank contributes to national development by financing infrastructure projects, including roads, bridges, and energy projects, which are vital for economic growth.

#### Challenges and Strategies

Despite its successes, Agrani Bank PLC faces several challenges, including:

1. **Non-Performing Loans (NPLs)**: Managing and reducing NPLs is a critical challenge, as high levels of bad debt can affect the bank’s profitability and financial health. Agrani Bank employs rigorous credit assessment procedures, effective recovery strategies, and robust risk management practices to address this issue.

2. **Technological Advancements**: Rapid technological changes necessitate continuous investment in IT infrastructure and cybersecurity to ensure seamless and secure banking services. The bank is committed to adopting cutting-edge technologies, enhancing digital platforms, and providing staff training to stay ahead in the digital banking landscape.

3. **Regulatory Compliance**: Adhering to evolving regulatory requirements is essential for maintaining operational integrity and customer trust. Agrani Bank ensures compliance through regular audits, comprehensive training programs, and close collaboration with regulatory authorities.

4. **Competition**: The banking sector in Bangladesh is highly competitive, with numerous private and foreign banks vying for market share. Agrani Bank differentiates itself through superior customer service, innovative products, and a strong focus on financial inclusion and rural banking.

#### Future Prospects

Looking ahead, Agrani Bank PLC is poised for continued growth and success, driven by several strategic initiatives:

1. **Digital Transformation**: Embracing digital technologies will remain a top priority, with investments in fintech solutions, AI-based analytics, and blockchain technology to enhance service delivery and operational efficiency.

2. **Sustainable Banking**: Agrani Bank is committed to promoting sustainable development by financing green projects, adopting environmentally friendly practices, and supporting initiatives that address climate change and social equity.

3. **Expansion and Diversification**: The bank aims to expand its product offerings and geographic reach, both domestically and internationally. This includes exploring new markets, developing innovative financial products, and forging strategic partnerships.

4. **Customer-Centric Approach**: Strengthening customer relationships through personalized services, loyalty programs, and enhanced customer support will be crucial for retaining and growing the customer base.

5. **Capacity Building**: Investing in employee training and development will ensure that the bank’s workforce remains skilled, motivated, and equipped to meet the challenges of a dynamic banking environment.

#### Conclusion

Agrani Bank PLC stands as a beacon of resilience and innovation in Bangladesh’s financial sector. Its comprehensive range of banking services, commitment to economic development, and strategic vision for the future underscore its role as a key player in the nation’s progress. As it navigates the challenges and opportunities of the modern banking landscape, Agrani Bank remains dedicated to fostering financial inclusion, supporting sustainable development, and delivering value to its customers, shareholders, and the broader community. Through continuous improvement and unwavering commitment, Agrani Bank PLC is well-positioned to contribute to Bangladesh’s economic growth and prosperity for years to come.