Bangladesh Bank

বাংলাদেশ ব্যাংক

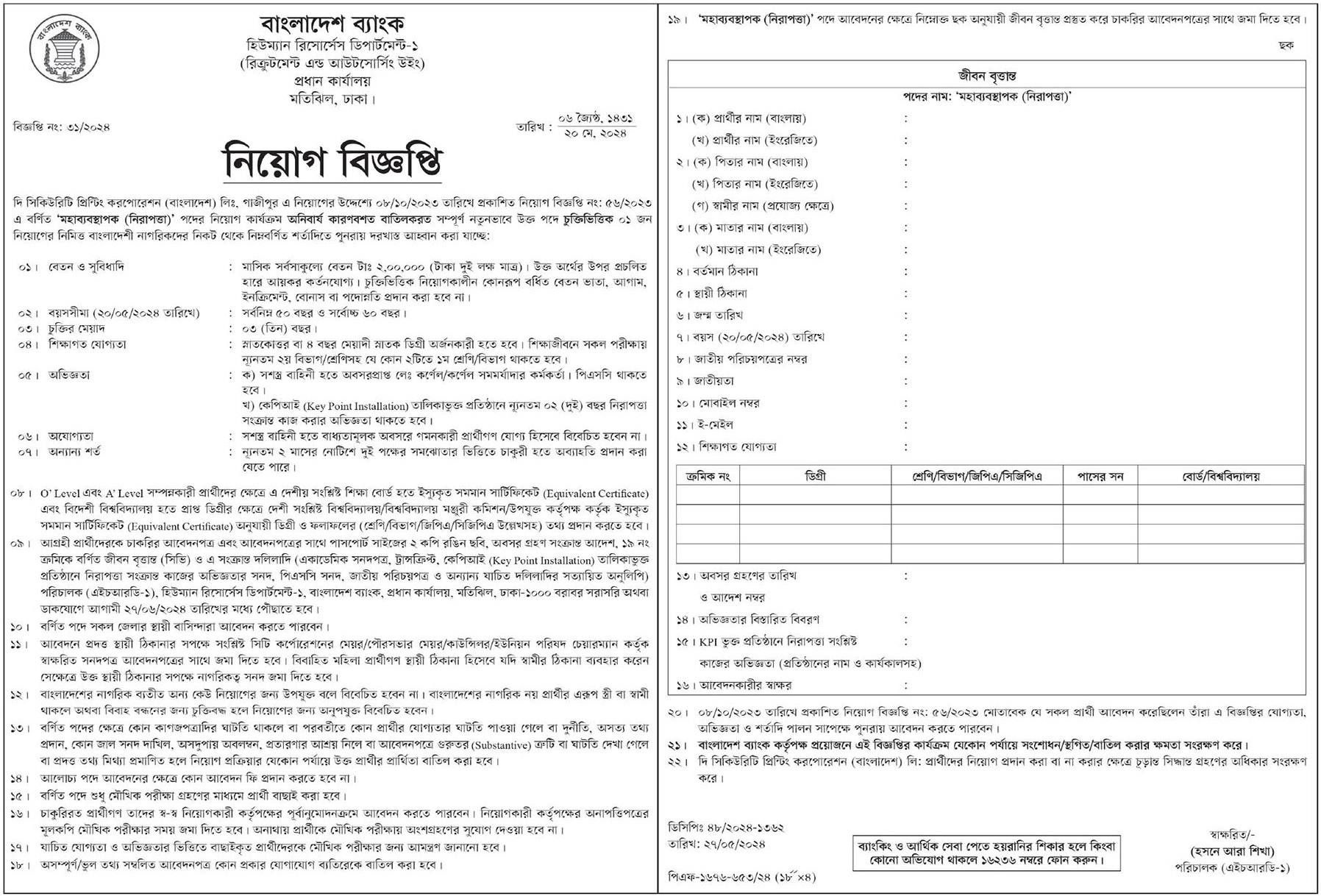

Job Category: Administration/General Management

Job Source: দৈনিক কালের কন্ঠ

Posted On: 28 May 2024

Application Deadline:27 Jun 2024

Welcome to our website bangladeshtodays.org. This is the best website online. Here you will get daily updates on all types of job news such as: E.g Job Vacancies in Public Sector, Private Sector, Corporate, Banking, NGO Jobs etc. You can select any type of job from the category option in the top menu of the website. You can apply for jobs directly on our website. There is a search option at the top of this website where you can search for jobs according to your requirements. If you have benefited even in the slightest from our website, then you can tell your friends, family and everyone else about this website. I hope you also benefit from this website. You can share this website post on Facebook, Instagram, Twitter or any other online platform if you want. Many people can benefit from your sharing. And if there is anything you want to know or understand, you can contact us by email on the contact page of this website. We will try our best to help you, thank you very much.

## Bangladesh Bank: An In-Depth Exploration

### Introduction

Bangladesh Bank (BB) is the central bank of Bangladesh and plays a pivotal role in the country’s financial and economic framework. Established under the Bangladesh Bank Order, 1972, it has grown into a significant institution in the country’s journey towards economic development and financial stability. This essay delves into the history, structure, functions, and impact of Bangladesh Bank, providing a comprehensive overview of its operations and contributions to Bangladesh’s economy.

### Historical Background

The inception of Bangladesh Bank can be traced back to the partition of British India in 1947 when the State Bank of Pakistan was created. After Bangladesh (then East Pakistan) gained independence from Pakistan in 1971, the need for a central bank to regulate the new nation’s monetary and financial systems became paramount. Consequently, Bangladesh Bank was established on December 16, 1971, and commenced operations on January 3, 1972, following the enactment of the Bangladesh Bank Order, 1972.

### Structure and Governance

Bangladesh Bank is a statutory organization, meaning it was created by legislation. The Bank is governed by a Board of Directors appointed by the government, and it includes the Governor, who acts as the chief executive officer, and several Deputy Governors. The structure of Bangladesh Bank includes various departments, each responsible for specific functions, such as monetary policy, financial stability, currency management, and banking regulation.

#### Board of Directors

The Board of Directors of Bangladesh Bank is responsible for the overall policy direction and management of the Bank. It consists of the Governor, who serves as the Chairman, and other directors appointed by the government. The Board makes crucial decisions regarding monetary policy, financial regulation, and the strategic direction of the Bank.

#### Governor and Deputy Governors

The Governor of Bangladesh Bank is the chief executive officer and is responsible for the day-to-day management of the Bank. The Governor’s role includes implementing the policies and decisions of the Board of Directors, overseeing the Bank’s operations, and representing Bangladesh Bank in international forums. The Deputy Governors assist the Governor in these tasks and oversee various departments within the Bank.

### Core Functions of Bangladesh Bank

Bangladesh Bank performs a variety of critical functions aimed at maintaining monetary and financial stability, fostering economic growth, and ensuring the smooth functioning of the country’s financial system. Some of the core functions include:

#### Monetary Policy Implementation

One of the primary responsibilities of Bangladesh Bank is to formulate and implement monetary policy. The main objective of monetary policy is to control inflation, manage liquidity, and ensure a stable financial environment conducive to economic growth. Bangladesh Bank uses various tools to achieve these goals, including open market operations, the discount rate, and reserve requirements for commercial banks.

#### Financial Regulation and Supervision

Bangladesh Bank regulates and supervises the banking sector to ensure its stability and soundness. This involves setting prudential guidelines, conducting regular inspections and audits, and taking corrective actions when necessary. The Bank aims to protect depositors’ interests, maintain public confidence in the financial system, and prevent financial crises.

#### Currency Issuance and Management

Bangladesh Bank has the sole authority to issue and manage the country’s currency. This includes designing and distributing banknotes and coins, ensuring their quality and security, and managing the country’s currency reserves. The Bank also monitors the money supply to prevent counterfeiting and ensure adequate liquidity in the economy.

#### Foreign Exchange Management

Managing the country’s foreign exchange reserves is another critical function of Bangladesh Bank. The Bank oversees foreign exchange transactions, regulates foreign exchange markets, and implements policies to stabilize the exchange rate. It also manages the country’s external debt and works to maintain an adequate level of foreign exchange reserves to support international trade and investment.

#### Payment Systems Oversight

Bangladesh Bank oversees the country’s payment and settlement systems to ensure their safety, efficiency, and reliability. This includes regulating electronic payment systems, promoting the use of digital payments, and facilitating the development of a modern payment infrastructure. The Bank aims to enhance financial inclusion and reduce transaction costs for businesses and consumers.

### Developmental Role

Beyond its core functions, Bangladesh Bank plays a significant developmental role in the country’s economy. It implements various policies and initiatives to promote economic growth, financial inclusion, and sustainable development.

#### Financial Inclusion

Bangladesh Bank has undertaken numerous initiatives to promote financial inclusion and expand access to banking services for underserved populations. These include promoting microfinance, encouraging mobile banking and agent banking, and supporting small and medium-sized enterprises (SMEs). The Bank also works to enhance financial literacy and consumer protection.

#### Green Banking and Sustainability

In recent years, Bangladesh Bank has placed a strong emphasis on green banking and sustainable development. It has introduced guidelines for banks to adopt environmentally friendly practices and finance green projects. The Bank also encourages investments in renewable energy, energy efficiency, and other sustainable initiatives to promote environmental sustainability and combat climate change.

#### SME Financing

Supporting SMEs is a key priority for Bangladesh Bank, given their significant contribution to the country’s economy. The Bank provides refinancing facilities, sets SME credit targets for banks, and offers capacity-building programs for SME entrepreneurs. These efforts aim to enhance access to finance for SMEs, promote entrepreneurship, and stimulate economic growth.

### Achievements and Impact

Over the years, Bangladesh Bank has made significant contributions to the country’s economic development and financial stability. Some of its notable achievements include:

#### Economic Growth and Stability

Through prudent monetary policy and effective financial regulation, Bangladesh Bank has helped maintain macroeconomic stability and support steady economic growth. The country’s economy has shown resilience in the face of global economic challenges, and Bangladesh has emerged as one of the fastest-growing economies in the world.

#### Financial Sector Development

Bangladesh Bank’s efforts to strengthen the financial sector have resulted in a more robust and resilient banking system. The Bank’s regulatory and supervisory framework has improved, and the financial sector has expanded and diversified. The introduction of digital banking and financial inclusion initiatives has also transformed the financial landscape, making banking services more accessible to the population.

#### Foreign Exchange Reserves

Bangladesh Bank has successfully managed the country’s foreign exchange reserves, maintaining an adequate level to support international trade and investment. This has contributed to exchange rate stability and enhanced the country’s creditworthiness in international markets.

#### Poverty Reduction and Social Development

The Bank’s initiatives in microfinance, SME financing, and financial inclusion have had a positive impact on poverty reduction and social development. By providing access to finance for low-income individuals and small businesses, Bangladesh Bank has helped improve livelihoods, create jobs, and reduce income inequality.

### Challenges and Future Outlook

Despite its achievements, Bangladesh Bank faces several challenges in fulfilling its mandate. These include:

#### Financial Sector Risks

The banking sector in Bangladesh faces risks such as non-performing loans (NPLs), operational inefficiencies, and governance issues. Bangladesh Bank must continue to strengthen its regulatory and supervisory framework to address these risks and ensure the stability of the financial sector.

#### Technological Advancements

The rapid advancement of technology presents both opportunities and challenges for Bangladesh Bank. While digital banking and fintech innovations can enhance financial inclusion and efficiency, they also pose risks related to cybersecurity, data privacy, and regulatory compliance. The Bank must adapt to these technological changes and develop appropriate regulatory frameworks.

#### Climate Change and Sustainability

Bangladesh is highly vulnerable to the impacts of climate change, and promoting sustainable development is crucial for the country’s future. Bangladesh Bank must continue to lead efforts in green banking and sustainable finance, encouraging the financial sector to adopt environmentally friendly practices and support climate resilience.

#### Global Economic Uncertainties

Global economic uncertainties, such as trade tensions, geopolitical risks, and economic slowdowns, can impact Bangladesh’s economy and financial system. Bangladesh Bank needs to remain vigilant and responsive to these external challenges, ensuring that its policies and strategies are adaptable to changing global conditions.

### Conclusion

Bangladesh Bank plays a central role in the country’s financial and economic system, contributing to monetary stability, financial sector development, and economic growth. Through its regulatory and supervisory functions, the Bank ensures the soundness of the banking sector, manages the country’s currency and foreign exchange reserves, and promotes financial inclusion and sustainable development.

As Bangladesh continues its journey towards becoming a middle-income country, the role of Bangladesh Bank will become even more critical. The Bank must navigate the challenges of a rapidly evolving financial landscape, technological advancements, and global economic uncertainties while fostering a stable and inclusive financial system. By continuing to adapt and innovate, Bangladesh Bank can support the country’s aspirations for sustained economic growth, social development, and environmental sustainability.