Socio Economic Banking Association (Service)

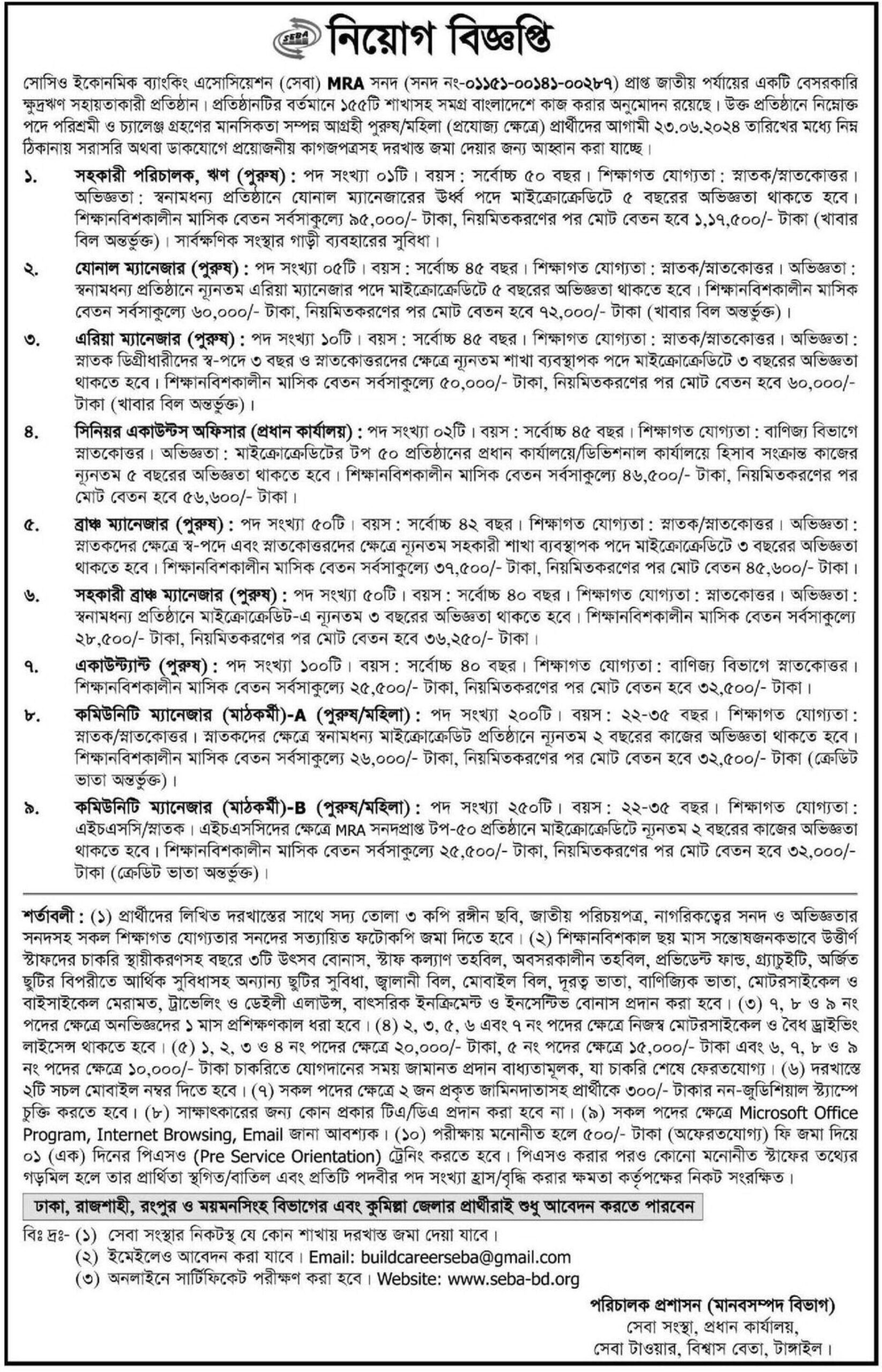

সোসিও ইকোনমিক ব্যাংকিং এসোসিয়েশন (সেবা)

Job Category: Accounts/Finance/Auditing

Job Source: দৈনিক প্রথম আলো

Posted On: 20 May 2024

Application Deadline:23 Jun 2024

Web: www.seba-bd.org

Welcome to our website bangladeshtodays.org. This is the best website online. Here you will get daily updates on all types of job news such as: E.g Job Vacancies in Public Sector, Private Sector, Corporate, Banking, NGO Jobs etc. You can select any type of job from the category option in the top menu of the website. You can apply for jobs directly on our website. There is a search option at the top of this website where you can search for jobs according to your requirements. If you have benefited even in the slightest from our website, then you can tell your friends, family and everyone else about this website. I hope you also benefit from this website. You can share this website post on Facebook, Instagram, Twitter or any other online platform if you want. Many people can benefit from your sharing. And if there is anything you want to know or understand, you can contact us by email on the contact page of this website. We will try our best to help you, thank you very much.

Title: Empowering Communities: The Role of the Socio-Economic Banking Association (SEBA)

Introduction:

The Socio-Economic Banking Association (SEBA) stands as a transformative force in the banking sector, dedicated to promoting financial inclusion, economic empowerment, and sustainable development. Through innovative banking services, community-focused initiatives, and strategic partnerships, SEBA seeks to bridge the gap between the traditional financial system and underserved communities. This comprehensive exploration delves into the history, functions, challenges, and impact of SEBA in fostering socio-economic growth and enhancing financial stability for individuals and businesses alike.

Historical Background:

The inception of SEBA was driven by a growing recognition of the need for more inclusive financial systems that cater to marginalized and underserved populations. Established in [insert year], SEBA emerged as a response to the limitations of conventional banking in addressing the unique financial needs of low-income individuals, small businesses, and rural communities. By adopting a mission-driven approach, SEBA has positioned itself as a catalyst for socio-economic transformation, leveraging financial services to create opportunities and promote equitable growth.

Functions and Responsibilities:

SEBA performs a multifaceted role in advancing financial inclusion, supporting economic development, and enhancing community well-being. Its core functions and responsibilities encompass:

1. Financial Inclusion and Access:

– Providing accessible banking services to underserved populations, including low-income individuals, rural communities, and small businesses.

– Developing tailored financial products such as microloans, savings accounts, and insurance schemes to meet the specific needs of diverse customer segments.

– Utilizing mobile banking, digital platforms, and branchless banking models to extend reach and accessibility, particularly in remote and underserved areas.

2. Economic Empowerment:

– Offering financial literacy programs, training workshops, and capacity-building initiatives to enhance individuals’ and businesses’ financial management skills.

– Supporting micro, small, and medium enterprises (MSMEs) through credit facilities, business advisory services, and market linkages to foster entrepreneurship and job creation.

– Promoting women’s economic empowerment by providing targeted financial products, mentorship, and support networks to women entrepreneurs and business owners.

3. Community Development:

– Collaborating with local governments, non-governmental organizations (NGOs), and community-based organizations to design and implement community development projects.

– Investing in infrastructure, education, healthcare, and social services to improve the quality of life and socio-economic conditions in targeted communities.

– Encouraging community participation and engagement in decision-making processes to ensure that development initiatives are responsive to local needs and priorities.

4. Sustainable Finance:

– Promoting environmentally sustainable investments and green finance initiatives that align with global sustainability goals and address climate change challenges.

– Supporting projects that focus on renewable energy, energy efficiency, sustainable agriculture, and conservation to drive eco-friendly economic growth.

– Encouraging corporate social responsibility (CSR) practices and ethical business conduct among clients and partners to foster a culture of sustainability and social responsibility.

Challenges and Considerations:

Despite its significant contributions, SEBA faces several challenges and considerations that impact its effectiveness and sustainability. These include:

1. Regulatory Environment:

– Navigating complex regulatory frameworks and compliance requirements can pose challenges for SEBA in delivering its services and expanding its reach.

– Advocating for supportive policies, regulatory reforms, and enabling environments is crucial to facilitate financial inclusion and innovation.

2. Financial Sustainability:

– Balancing the dual objectives of social impact and financial viability requires careful planning, resource mobilization, and risk management.

– Developing diversified revenue streams, innovative financing models, and strategic partnerships is essential to ensure long-term sustainability.

3. Technology and Infrastructure:

– Limited access to technology and infrastructure, particularly in rural and remote areas, can hinder the adoption of digital financial services and inclusive banking models.

– Investing in technology infrastructure, enhancing digital literacy, and promoting technology adoption are critical to overcoming these barriers.

4. Capacity and Skill Development:

– Building the capacity and skills of staff, partners, and clients is essential to deliver high-quality services and achieve desired socio-economic outcomes.

– Implementing training programs, mentorship initiatives, and professional development opportunities can strengthen capacity and enhance service delivery.

Impact and Achievements:

SEBA’s efforts have yielded significant impact and achievements in advancing financial inclusion, economic empowerment, and community development. Some notable accomplishments include:

1. Expanding Financial Access:

– SEBA has successfully extended banking services to millions of previously unbanked and underbanked individuals, providing them with access to essential financial products and services.

– The adoption of mobile banking and digital platforms has facilitated greater financial inclusion, enabling users to perform transactions, save, and access credit conveniently.

2. Empowering Entrepreneurs:

– Through targeted support for MSMEs, SEBA has fostered entrepreneurship, created jobs, and stimulated local economies, contributing to poverty reduction and economic growth.

– Women entrepreneurs have particularly benefited from SEBA’s initiatives, gaining access to financial resources, mentorship, and networks that enhance their business prospects and economic independence.

3. Community Impact:

– SEBA’s community development projects have led to tangible improvements in infrastructure, education, healthcare, and social services, enhancing the overall quality of life for residents.

– Community engagement and participation have been central to SEBA’s approach, ensuring that development initiatives are aligned with local needs and priorities.

4. Promoting Sustainability:

– SEBA’s commitment to sustainable finance has supported numerous green projects and environmentally friendly investments, contributing to climate resilience and sustainable development.

– The promotion of CSR practices and ethical business conduct has fostered a culture of sustainability and social responsibility among clients and partners.

Future Directions and Strategic Priorities:

Looking ahead, SEBA aims to build on its achievements and address emerging challenges through strategic priorities and future directions. These include:

1. Enhancing Digital Financial Services:

– Expanding and upgrading digital financial services, including mobile banking, online platforms, and fintech solutions, to enhance accessibility and convenience for users.

– Strengthening cybersecurity measures, data protection, and digital literacy to ensure the safe and effective use of digital financial services.

2. Deepening Financial Literacy and Education:

– Scaling up financial literacy programs, training workshops, and educational campaigns to empower individuals and businesses with the knowledge and skills needed to manage their finances effectively.

– Collaborating with educational institutions, community organizations, and media to promote financial education and awareness.

3. Scaling Up Impact Investments:

– Increasing investments in projects and initiatives that generate positive social, economic, and environmental impacts, aligning with SEBA’s mission and values.

– Leveraging impact investing principles, innovative financing models, and strategic partnerships to mobilize resources and maximize social returns.

4. Strengthening Partnerships and Collaborations:

– Building and strengthening partnerships with governments, NGOs, private sector actors, and international organizations to enhance collaboration and synergy in achieving common goals.

– Engaging in policy advocacy, knowledge sharing, and joint initiatives to influence systemic change and promote an enabling environment for inclusive finance and development.

5. Monitoring and Evaluating Impact:

– Implementing robust monitoring and evaluation frameworks to assess the effectiveness and impact of SEBA’s initiatives, programs, and services.

– Using data-driven insights, feedback mechanisms, and impact assessments to inform decision-making, improve performance, and demonstrate accountability.

Conclusion:

In conclusion, the Socio-Economic Banking Association (SEBA) plays a vital role in advancing financial inclusion, economic empowerment, and sustainable development. Through innovative banking services, community-focused initiatives, and strategic partnerships, SEBA addresses the unique needs of underserved populations and fosters socio-economic growth. Despite challenges, SEBA’s proactive efforts, strategic initiatives, and collaborative approach have made significant strides in transforming lives, empowering communities, and promoting equitable development. By focusing on digital innovation, financial education, impact investments, and partnerships, SEBA continues to pave the way for a more inclusive, resilient, and sustainable financial future.